Some time ago I met a client requesting our help to brand his decade-old business, let’s call him Spock. After understanding Spock’s objectives and expectations, we recommended a desk research and customer survey as part of the branding exercise. As with many clients, “But I already know my industry well” is among the common responses.

And I can hardly blame him. Market research has been around for a long time but not widely adopted by SMEs because of various reasons. A Google search for “market research” leads you to a set of different methodologies like ethnography, panel research, bulletin board, omnibus, focus groups, in-depth interviews, etc., that will make us feel like we’re reading a handbook on FBI interrogation techniques. What can we get out of this mumbo jumbo?

How to properly conduct market research for branding

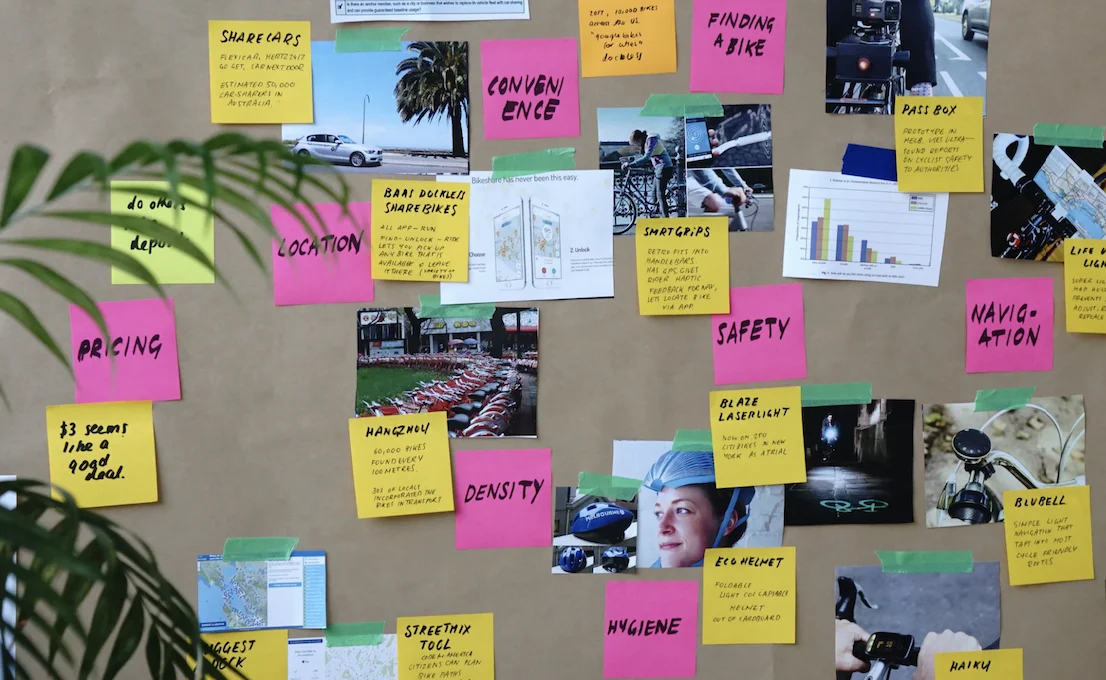

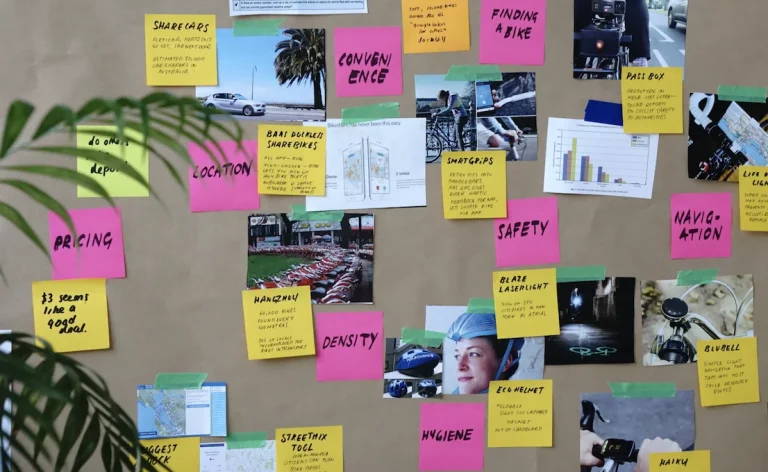

The trick is to not worry about terminologies, as you are likely already conducting some research on your own. What market research does is to formalise processes to obtain insights in a more structured and actionable way (along with a fancier name).

One of the keys to successful branding is by 1st understanding your customers. You should already roughly know who they are based on your daily interactions, but demographics data only scratches the surface. To really understand customers we need to tap into their psychography, understanding their behaviour, their motivations, their patterns and their desires. Take TWG, for example. You know them as the 1st upscale tea brand in Singapore. But have you ever stopped to wonder, Why did 2 foreigners decide to set up their tea business in Singapore of all places? Isn’t selling tea to Asians akin to selling ice to eskimoes? Wasn’t it why Starbucks steered clear of Italy in the 1st place?

Well, it turns out that Singapore was strategic because

- The tea culture and tradition isn’t ingrained in Singaporeans as they do in other parts in Asia

- A Singapore brand brings prestige for overseas expansion

- Singaporeans have the buying power, prefer novelty and desire the upscale lifestyle image

All these findings coupled with the founders’ vision, helped shape the TWG brand we see today.

Identifying unique selling points

Market research also allows us to uncover gaps in the industry and have a distinctive brand positioning. Remember the bubble tea craze that saw outlets mushrooming from every corner? What was once a novelty soon descended to a price war. Bubble tea became this commodity that you can find in most hawker centres, and many outlets closed down soon after.

Those who survived the trend did so because they were distinguished by a combination of distinctive brand history, brewing methods, flavours and staff attitude. I personally prefer KOI, but my friends are Gong Cha legions.

But how has this got to do with market research you ask? You have to remember that you only have an advantage if

- The experience can’t be copied easily

- The market cares about that unique attribute you’re touting.

Market research helps to verify if what you’re proposing holds water.

Back to Spock’s scenario, through market research we later found out that competition is stiff in the industry and there is little differentiation. Customers were looking for services that weren’t commonly available yet. We verified the finding with industrial trends and advised him toward that direction.

That said, market research is a common approach to provide intel for a branding strategy. It allows you to check your hypothesis against quantifiable data from a neutral perspective and helps you reorganise priorities. A small price to pay compared to embarking on the wrong direction.